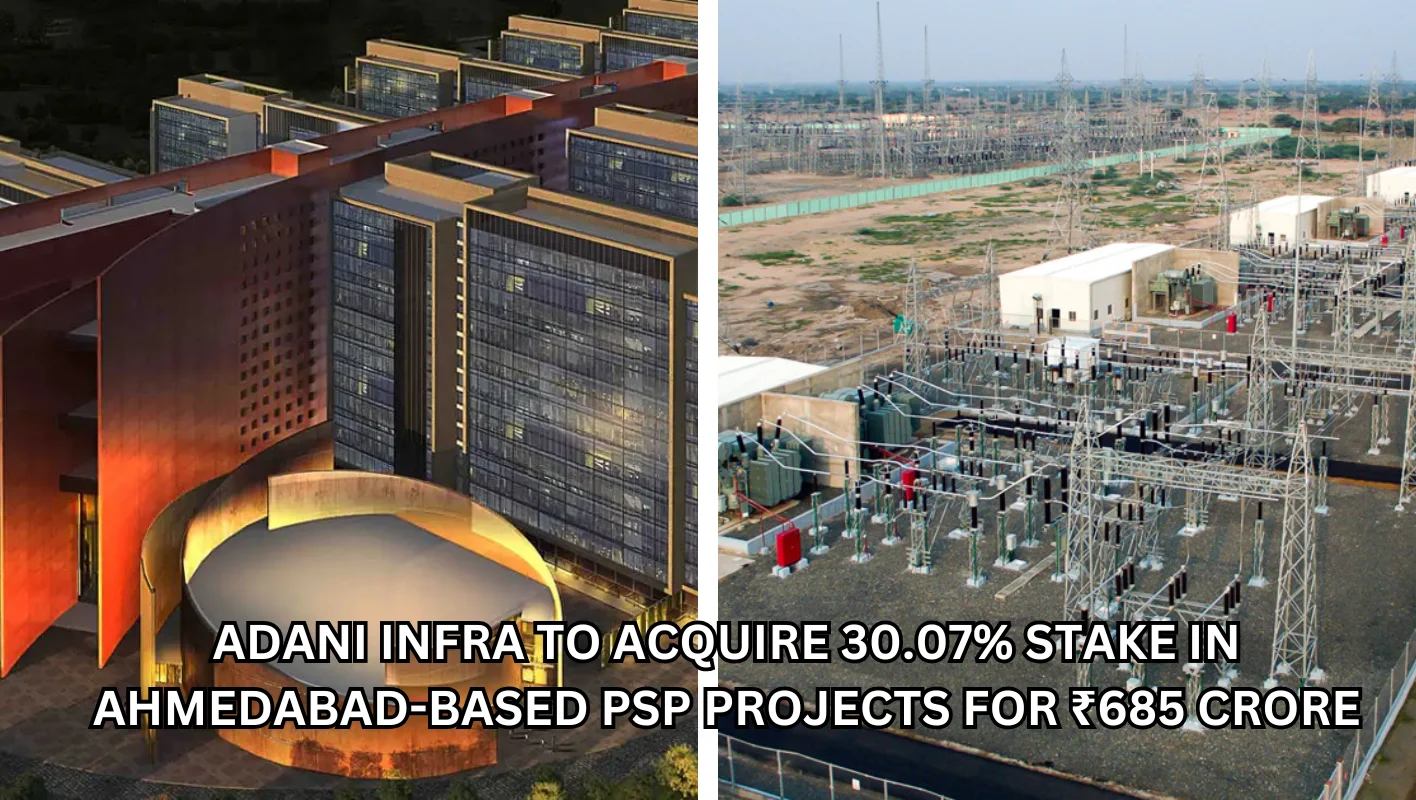

Adani Infrastructure, one of the Group’s major subsidiaries, has emerged as the biggest competitor in the construction sector with the acquisition of a 30.07 percent stake in Ahmedabad-based PSP Projects for ₹685 crore, consolidating the position of the Adani Group in the diversification of operations and establishing it as the India construction and real estate market leaders.

PSP Projects, known for its expertise in delivering projects across residential, commercial, institutional, and industrial sectors, aligns seamlessly with Adani’s vision of creating a robust infrastructure ecosystem.

The acquisition allows Adani Infra to integrate PSP’s construction expertise into its broader portfolio, paving the way for innovative, large-scale projects that cater to India’s growing urbanization needs.

It would reflect the strategic intent of Adani Infra to consolidate its position in the infrastructure sector, leveraging PSP Projects’ established ability to create a stronger, more competitive offering in the market.

Table of Contents

Betting Big on Regional Strength to Scale to the Nation

PSP Projects has good brand equity and operational footprint in the state of Gujarat and the adjoining states. With this acquisition, Adani Infra will scale up PSP’s regional play to an all-India level, focusing specifically on these Tier-2 and Tier-3 cities with vast untapped potential.

These are fast-growing cities with an increase in urbanization activity promoted by the government for smart cities and steadily increasing demand for modern infrastructure.

PSP Projects, with the leadership it has exhibited in quality project execution, is likely to enjoy faster growth under the collaborative synergy with Adani Infra, whose strong financial muscle would support the growth momentum.

This is because Adani will bring PSP Projects’ innovative solutions to newer geographies to meet the emerging needs of infrastructure in those regions, which will include building high-quality residential projects, state-of-the-art commercial spaces, and modern industrial facilities.

The deal also positions Adani Infra on the best side of meeting long-term Indian infrastructure objectives as well as establishing sustainable cities, industrial corridors, and other strategic developments. This in turn places it squarely into India’s national priorities as a win-win for Adani, PSP Projects, and India’s infra sector at large.

Synergistic collaboration for advanced capabilities

The deal will unlock a powerful joint venture built upon both companies’ respective strengths: PSP Projects on innovative construction techniques, details, and timely completion of projects to a loyal customer base and with an impressive portfolio having cemented the name in society and Adani Infra, with deep pockets, management depth, and international reach.

Such will make it possible for PSP Projects to execute large-scale projects in a huge and productive manner. Financially strong, the Adani Group will now enable PSP Projects to quote for and execute bigger, complex projects, while PSP’s technical expertise will ensure that these projects are executed in the best-quality manner.

This will also unlock some real potential for embracing the latest technologies and innovative construction techniques. The integration of state-of-the-art tools like Building Information Modelling, drone-based surveys, and green construction will help Adani and PSP Projects set new industry benchmarks.

Driving Innovation in the Indian Construction Industry

One of the significant areas of impact is the influence of technological advancement in construction. The needs of infrastructure in India have been changing rapidly, rocketing at a pace.

The current need pressing in today’s time is for sustainable and smart city development, thereby providing scope for Adani Infra to collaborate with PSP Projects towards meeting this need by employing technology-driven solutions and eco-friendly practices.

Adani Infra’s focus on sustainability reflects PSP Projects’ commitment to quality, green, and pollution-free construction. The partnership will likely ensure green building certifications, energy-efficient designs, and waste-reduction practices in its future projects.

This does not only adapt to the global standards of sustainability but is also sensitive to environmentally conscious clients and investors.

With the partnership, both companies will remain open to collaborating on opportunities in smart city development. This includes IoT-enabling systems, intelligent infrastructure, and advanced mobility solutions, to name a few. Such endeavors could be instrumental in redefining how Indians live in their urban spaces – much safer, convenient, and quality-driven.

Strategic Approach to Overcome Challenges

Huge issues will also emerge in this transaction: operational and corporate integration. There are two companies with distinct processes and management styles; Adani Infra and PSP Projects have to integrate everything that exists with each other to profit from their combination.

To address this, Adani Infra must establish a clear integration roadmap that defines roles, responsibilities, and operational synergies. A strong communication strategy will also be critical to align the teams and foster collaboration across functions.

Another challenge is that the construction industry is indeed a very competitive business. Here, companies like Larsen & Toubro (L&T), Shapoorji Pallonji, and so many others are competing for the same market pie.

Adani-PSP, therefore, will have to carve out some niche for themselves. They could do that by combining their expertise to provide quality projects, faster, and more cost-effectively.

The last risk area is economic volatility, particularly when the industry is very sensitive to the ever-changing factors that include raw materials prices, labor availability, and government policies. Adani Infra and PSP Projects must have effective risk management policies such as hedging of prices, portfolio diversification of various projects undertaken, and having adequate financial reserves.

Value for the Stakeholder

For all stakeholders, this Adani-PSP partnership will generate immense value:

1. Investors

The acquisition has already manifested positive impacts on the PSP Projects’ performance in terms of stock performance, an indicator of investor confidence in the deal. Financial support from Adani enhances growth potential and makes PSP an attractive investment for institutional as well as retail investors.

2. Clients

Improved capabilities in the company will benefit the clients of Adani Infra and PSP Projects. From faster execution of projects to innovative designs or even sustainable construction solutions, it is guaranteed that clients receive top-notch services customized according to client needs.

3. Employees

It will provide career development and staff skill-upgrading opportunities for employees of both companies. Employees will be exposed to big projects, advanced technologies, and a wider scope of operation with their new employers and shall upgrade their skills and career prospects.

4. Local Economy

The partnership will probably generate considerable opportunities for employment in construction and ancillary industries. As the investment in regional development benefits the economic activities of Gujarat and other states in which the projects are implemented, the collaboration supports these economic activities.

Alignment with India’s Infrastructure Goals

The acquisition fits perfectly with the aggressive targets that are presented for the development of infrastructure through initiatives such as the Smart Cities Mission, Make in India, and the National Infrastructure Pipeline.

The partnership will have enormous potential to contribute to these initiatives because Adani brings much-needed financial strength and PSP brings much-needed operational expertise.

That encourages the development of high-quality, large-scale projects that can support the government’s goal of developing a modern and sustainable city with upgradation in the industrial infrastructure as well as improvement in public amenities. It also resonates with the emerging trends worldwide related to urbanization-reliance on innovation and sustainability for growth drivers.